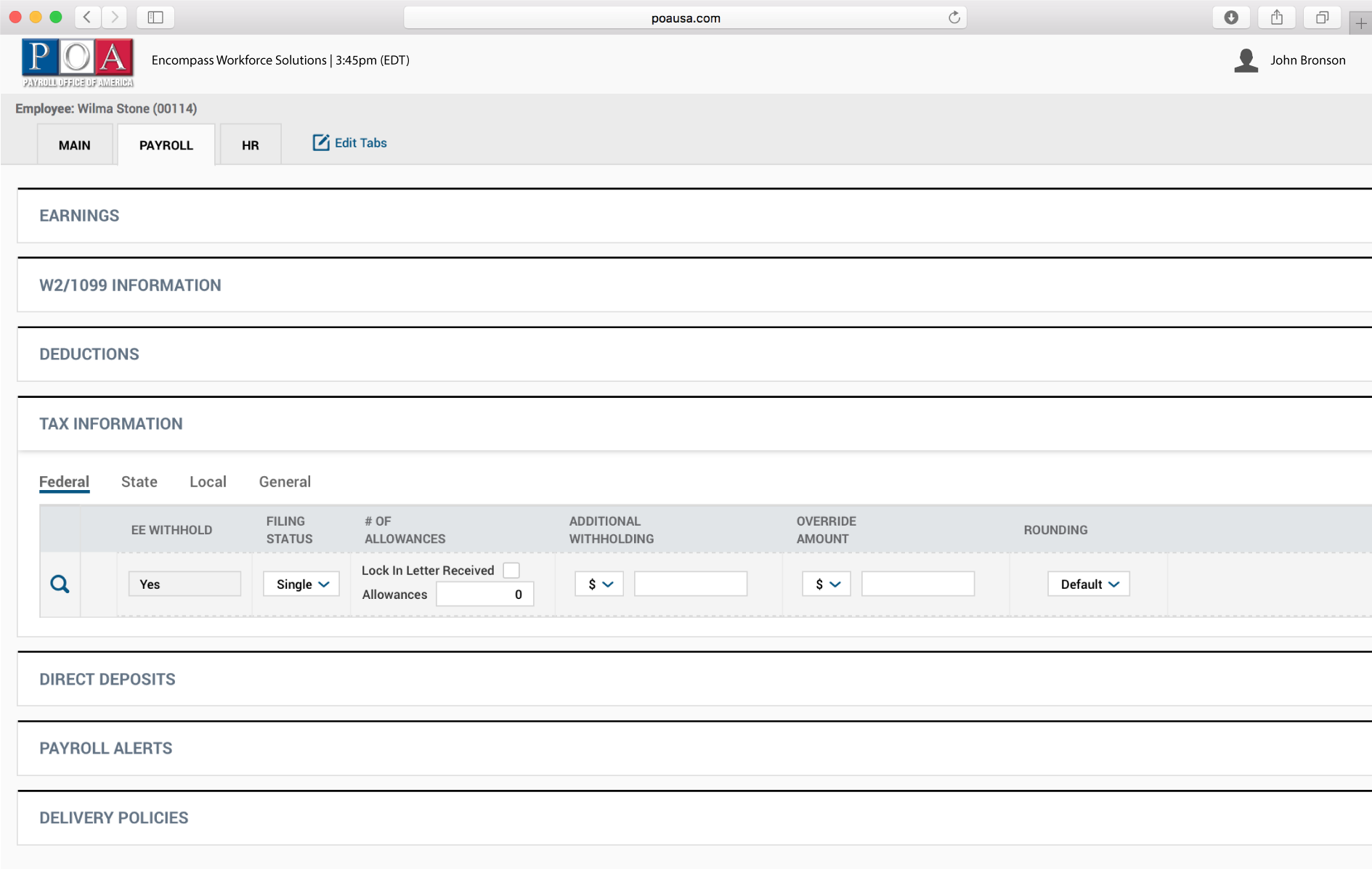

Our payroll module puts you in complete control of your payroll – every step of the way.

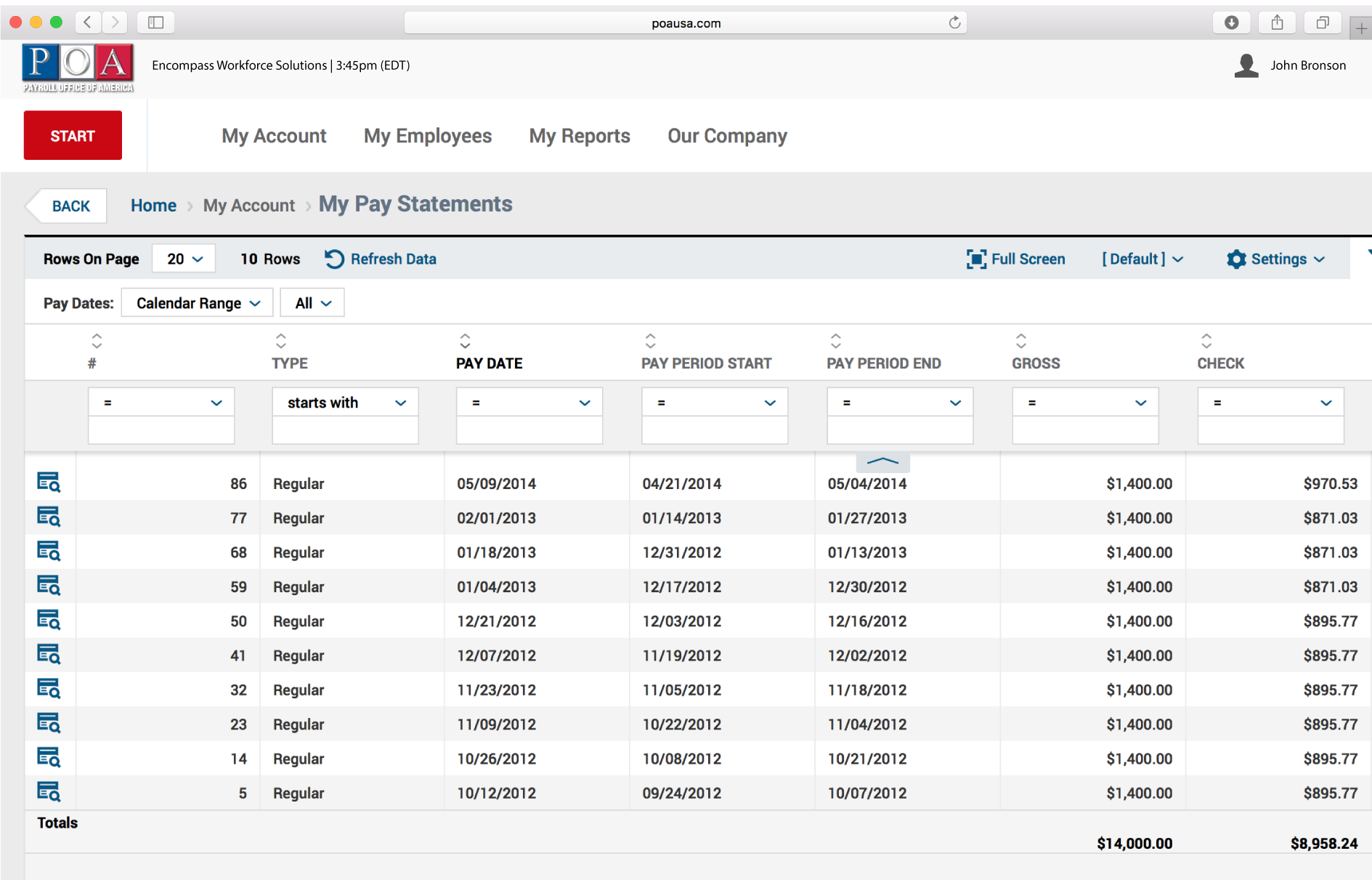

Payroll data is available whenever you need it, continuously.

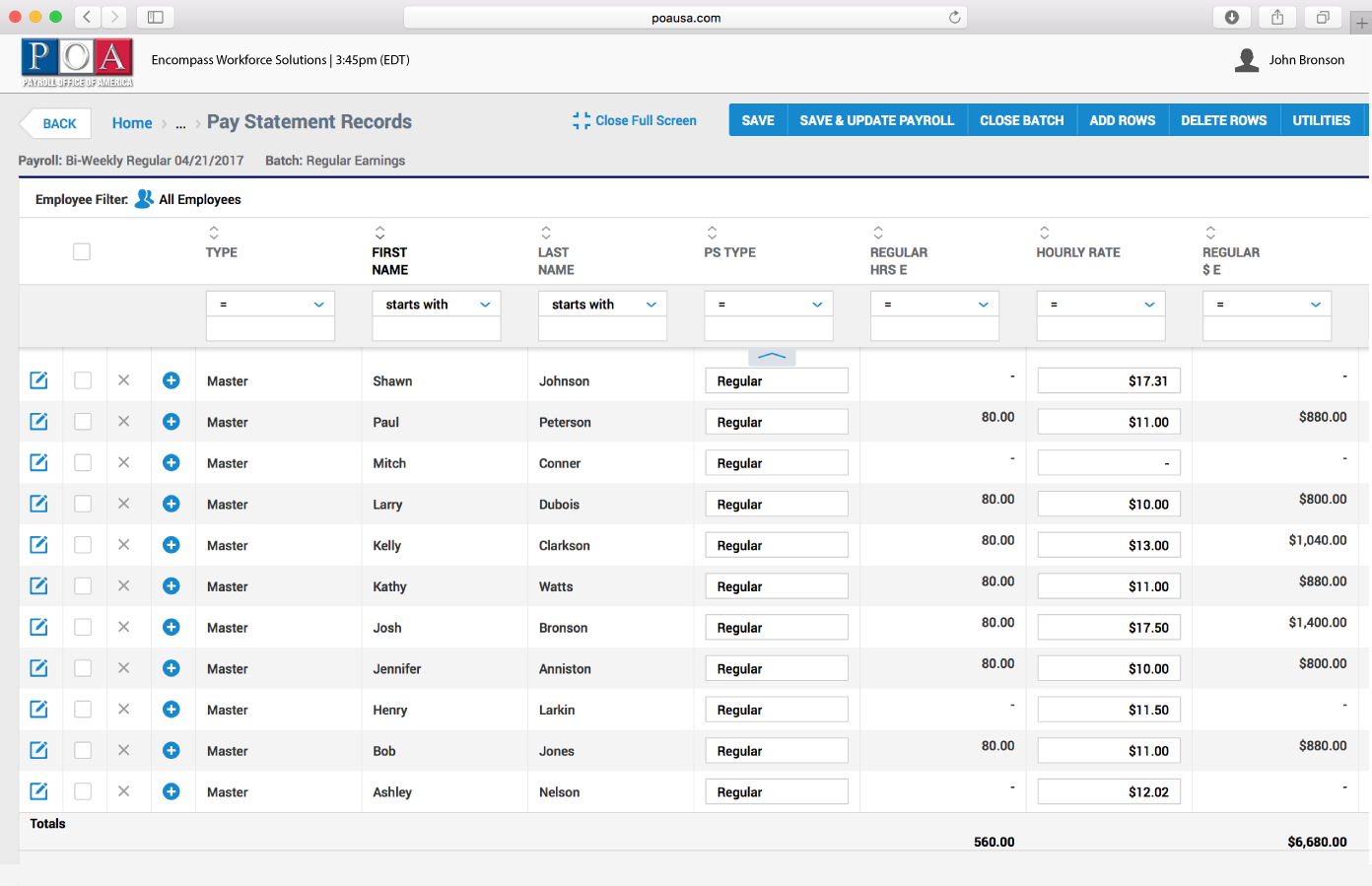

Payroll totals updated automatically in real time during pre-process earning adjustments.

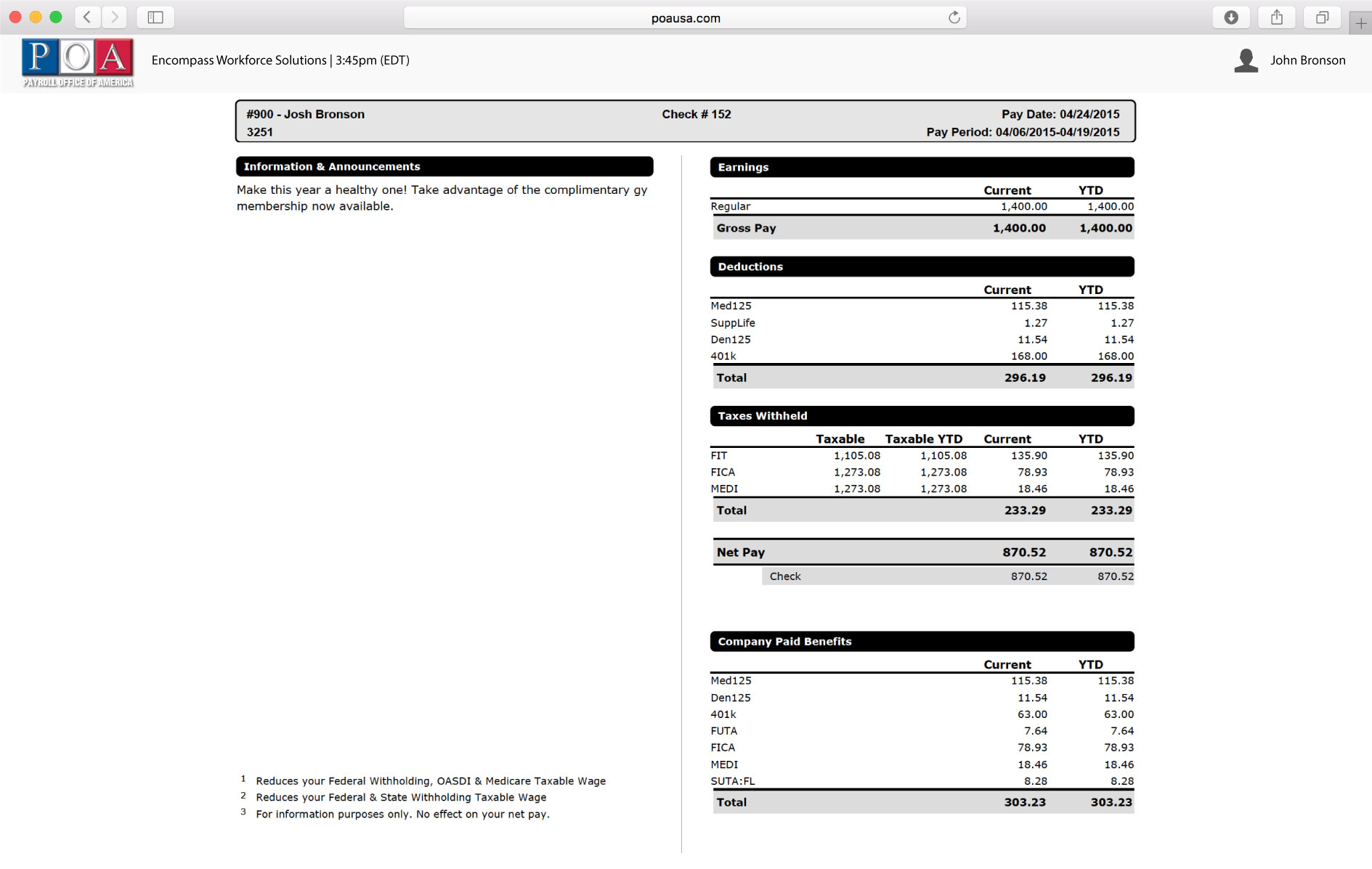

Preview pay statements, direct deposit and W4 change history.

Built in to our payroll module to support multiple regional requirements and tax structures.

Deliver company forms and documents, complete online performance reviews, manage turnover, and more. These features are presented in an easy-to-use, online system that incorporates important compliance measures.

Instantly deliver benefits to employees through their self-service center. Each employee benefit menu is customized to include the rates and benefits that apply to them.

Get a handle on your labor costs and reduce compliance risk by automating and simplifying your time & attendance processes. Perform time & attendance management, accruals, leave management and scheduling functions through one powerful application.

POA’s simple, paperless onboarding process helps to recruit and retain talent.

Applicant Tracking

Onboarding Checklists

Performance Management

Compliance

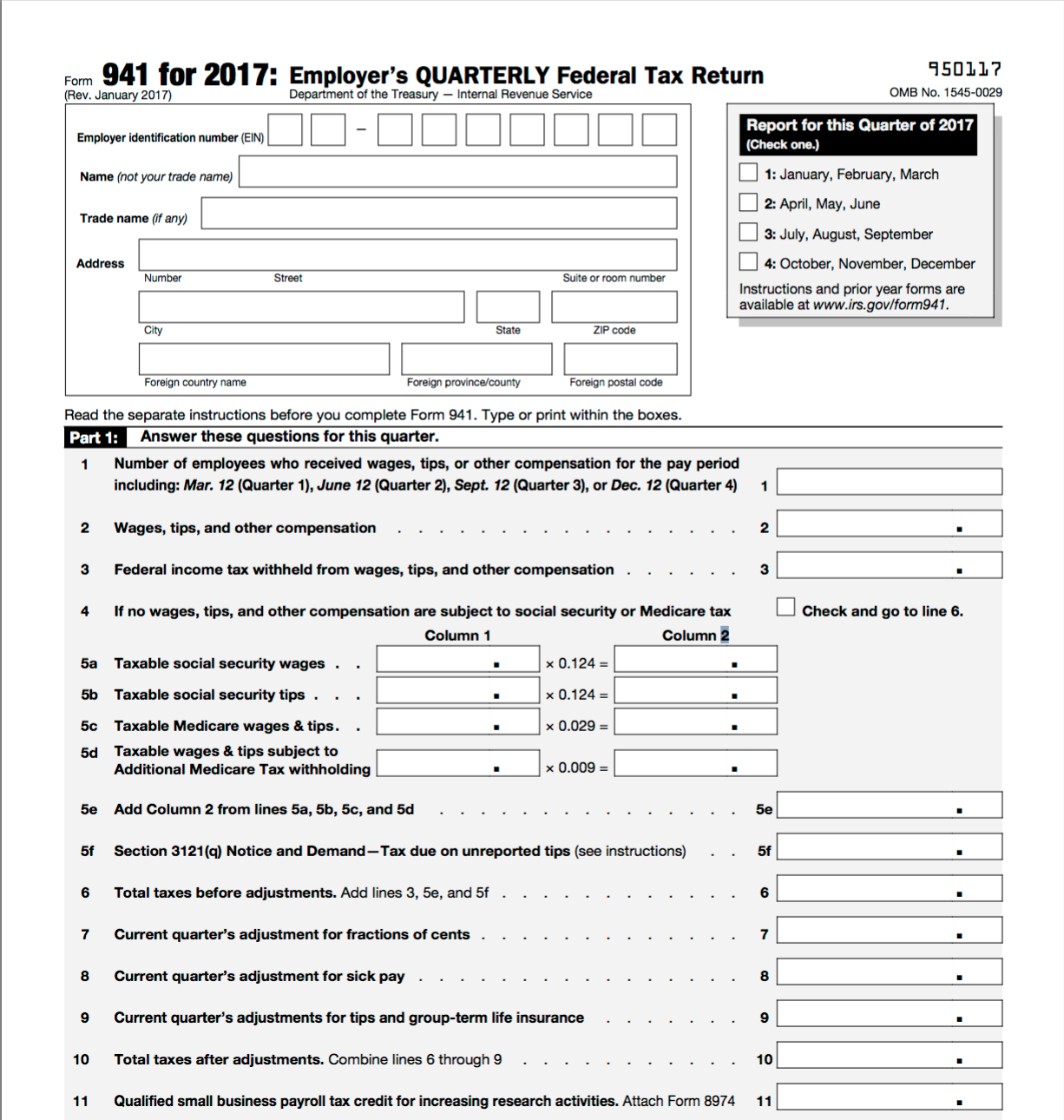

Full service payroll tax reporting and tax payments

We’ll handle all correspondence with IRS, state, and local jurisdictions

Enables proactive management of ACA compliance across the entire workforce with real-time status availability and eligibility notifications.

Provides automated tools for tracking and monitoring regular and variable-hour employees in Time Tracking to maintain benefit compliance with IRS requirements and applicable reporting.

Smaller and medium businesses are 72% more likely than enterprise organizations to indicate that maintaining compliance with regulations and reporting requirements is a driver for their organization’s total workforce management efforts

~ Workforce Management for the SMB: Big Results for Small and Medium Businesses (2015) – Aberdeen Group

Workers’ Comp Reporting

Low deposit requirements

Premiums calculated and deducted each payroll cycle

Improve cash flow by adjusting premium to payroll fluctuations

Monthly carrier reports filed for you

Save time and money while eliminating paper checks

Reduce year end premium audit risk

Most audit reports produced by POA

Amerisafe

AmTrust North America

Builders Insurance Group

Castlepoint

CNA

E-Comp Wholesale

Employers

Utica National Insurance Group

FCCI

Frank Crum Insurance

FUBA

Guarantee

Hartford XactPAY

ICW Group

Key Risk

MCIM

Mimic Insurance

Normandy Harbor

Opta Comp/Comp Options

Selective Insurance

State Compensation Insurance Fund

Summit Holdings

The Sheffield Fund

Travelers – TravPay

The Zenith